- A home equity mortgage allows you to availableness the brand new guarantee you have established upwards of your home.

- It is exactly how one to trader, Kent He, provided new deposit to own 1st money spent.

- According to him that had he never ever ordered their top household, he may n’t have were able to buy apartments.

« I wanted to begin to build wide range, » The guy advised Insider. In addition to, they generated experience timeline-wise. Immediately after renting from inside the Boston consistently, that they had moved to San diego and you can, « we decided, at least, we had been planning sit truth be told there for around around three so you can 5 years. »

Their home get ended up leading to so much short-title wide range which he managed to end their position when you look at the 2022.

They don’t pick and flip their home; rather, it noticed that their residence got enjoyed when you look at the well worth and then made use of what’s named a property equity loan to withdraw a serious chunk out-of equity and purchase it to your a short-term local rental.

« Basically never ever bought my no. 1 household, i quickly most likely would not keeps received new equity to shop for short term-leases, » told you this new 34-year-dated, that is financially separate due to the one or two bachelorette-inspired Airbnb qualities he is the owner of into the Scottsdale, Arizona.

Its time is actually an excellent, He indexed, as they gained in the housing market frenzy fueled by pandemic: « Whenever we never ordered, we may never have had an increase in collateral if housing industry went most crazy. »

How household collateral finance functions

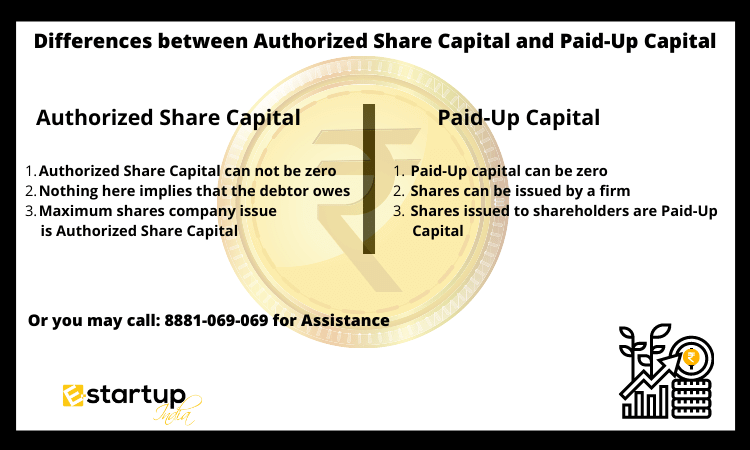

Their equity is the property’s worthy of without sum of money you borrowed from on the financial. Say your home is really worth $three hundred,000 and also you are obligated to pay $150,000 on your home loan. Meaning you may have $150,000 regarding « equity » – and you may be able to borrow against a number of you to definitely which have a property guarantee financing.

Lenders generally enables you to borrow to a blended ratio away from 80% to help you ninety% of house’s well worth, and also you acquire the whole sum up top. Family equity money generally speaking incorporate a fixed rate of interest, definition possible make equivalent monthly obligations before the financing is paid down right back.

Despite has just purchased in 2019, He taken place to own numerous equity as their family got appreciated significantly inside value.

« As soon as we purchased, our home is $800,000, nevertheless ran upwards $2 hundred,000 into the really worth, » he said click here to investigate. « Because the we could take out 80% of this, we could take-out as much as $160,000 from domestic collateral for action into the whatever i desired, out of resource developments at home to help you considering other ways to expend the cash. »

Associated reports

Into the , immediately after thorough marketing research, the guy ordered a house when you look at the Scottsdale, Arizona and you may invested three months converting they with the a great bachelorette-styled Airbnb.

« In 30 days of it going live, we’d almost $100,000 in reservations, » the guy told you. « It absolutely was very crazy. I’d over most of the my personal lookup, however, there aren’t any claims. It was very, awesome observe these bookings have and watch you to people resonated as to what i put-out. »

They are comparable for the reason that you happen to be tapping into your own home’s collateral, but the method by which obtain the money varies: Which have property collateral loan, you earn a lump sum payment at once; having a HELOC, you get a credit limit to borrow on during the the brand new « mark several months, » that’s generally speaking four to ten years.

Having fun with a HELOC is yet another solution to money a residential property if you don’t have enough upfront bucks into the down-payment. It is exactly how one to Virginia-created individual who never generated more than $52,000 annually, but wound up obtaining 25 local rental tools and you may retiring very early, had their start.

Had He never ever bought his number one home, he might n’t have been able to purchase Airbnb features. While you are an occupant, imagine rescuing upwards for your earliest household purchase, the guy told. In that way, you can begin building collateral, gives you alternatives.

« I believe for a number of someone, within the last 2 or 3 decades, there’s a lot from nested security in their property, » he told you. Possibly it will not make sense to market and you may disperse property, as the interest levels is actually relatively high today, the guy added, « however are in fact equipped with an alternate device on the tool buckle. Given this equity, perhaps you takes it and put they with the a keen financial support, so long as new funding makes sense and it also fits their risk urges. »