According to a few of these documents, in the event the lender try certain that your panels is safe in order to lend currency to possess, the loan will be approved.

It must be noted that expenditures you have got getting the brand new interior spaces of your own strengthening is omitted on the mortgage.

Confirmation Processes Having Home Framework Financing

Technology Verification: New authenticity of requisite are verified of the get across-guaranteeing the property. It must be indexed that up until a hundred% fees of mortgage, the house or property are owned by the lending company and can be placed upwards to own public auction in the event of several non-payments in the installment.

Legal Verification: A nominated lawyer regarding financial often today charge you the newest courtroom files of the property. Your fill in most of the records in it into strengthening together with bank keeps them immediately after examining up until the full loan installment. This is accomplished if for example the strengthening/property is install to own public auction of the lender

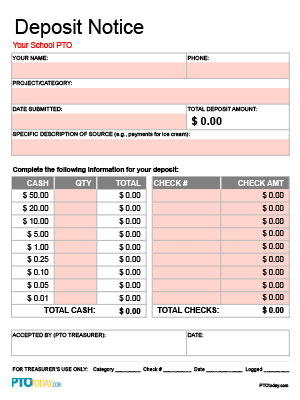

Household Structure Loan Disbursement: The loan repayments begin after all of the conformity was complete and you can the home try fully confirmed. The latest repayments are performed in the form of cheques, finalized by functions director.

Rather than the fresh new fee method of mortgage brokers having ready getting possession services, Build funds are paid-in pieces, labeled as Pulls.

Draws are ready intervals at which the lending company fund the development. What number of times therefore the amount at every of them was discussed and you may determined by the builder, client, and the bank/financial.

Such, state the quantity is determined become 10 % at each and every period. Thus, you will get the initial ten% of one’s loan in the event that financing is actually signed, next can come if the point is supplied additionally the basis try placed. Accompanied by the next draw when glory and you may roofing is determined and the like. Always, the original draw is composed of the fresh new down-payment.

not, for additional draws the bank will require particular proof of brand new build advances at each and every period to fund the project after that, whereby it is you’ll need for the customer to provide her or him which have photo regarding the framework and certificates on company on the the brand new stage regarding completion.

More over, you ought to make believe together with your lender on the venture capital that have proofs, throughout the lack of and that, the lending company also can posting a tuned technician to test the fresh improvements by themselves.

Top lenders such as SBI, HDFC Ltd, ICICI Lender, etcetera., is actually mixed up in structure mortgage sector. Yet not, Bangalore natives trust Bajaj Fund Minimal to possess an increase be certain that business getting funds into flats, assets and lower than structure https://paydayloansconnecticut.com/weston/ strategies as they go after RBI repaired notice rates.

An informed structure loan companies helping in town regarding Bangalore was : Coming Finance (Chandigarh), Sree Financial (Malleswaram, Bangalore), KMB Couples LLP (Shankarapuram, Bangalore), Sutapa Dutta (Mumbai), Pleased Lifestyle Economic Characteristics (BTM Concept, Bangalore)

Margin Currency

Like many funds, so that the applicant’s capital and interest in the project the guy has to lead on the construction. This contribution is known as ount off financial.

It gives brand new plot’s costs if it was bought earlier. not, the purchase price won’t be integrated if for example the patch are your own personal since the beginning otherwise is a present.

Household Design Loan Restriction

Based on almost any is lower, you can either rating that loan of up to one hundred% of one’s estimated design price or even to a maximum of 90% of the market price. on the financing needs doing Rs. 29 lakh*.

Projected design pricing is constantly formal by the a beneficial chartered engineer/designer and you can properly confirmed by the Technical Manager. According to any kind of is actually earlier the utmost label of your home mortgage can either be up to 30 years or never expand outside of the retirement age.