Frequently asked questions

In the event that you to continue together with your home loan alternatives, you will need to become a member through the use of an effective $5 dollars put to your a checking account. This $5 holds your co-possession of one’s borrowing from the bank partnership.

Interest levels vary according to many different products, along with rising prices, the rate away from monetary growth, and you can Government Set-aside policy. Over time, inflation provides the premier affect the amount of rates of interest. A small rate out-of rising cost of living will always trigger lower-rates of interest, while you are concerns about rising rising cost of living usually end up in rates of interest to boost. Our state’s main lender, brand new Government Put aside, tools guidelines built to remain inflation and rates of interest seemingly low and you can stable.

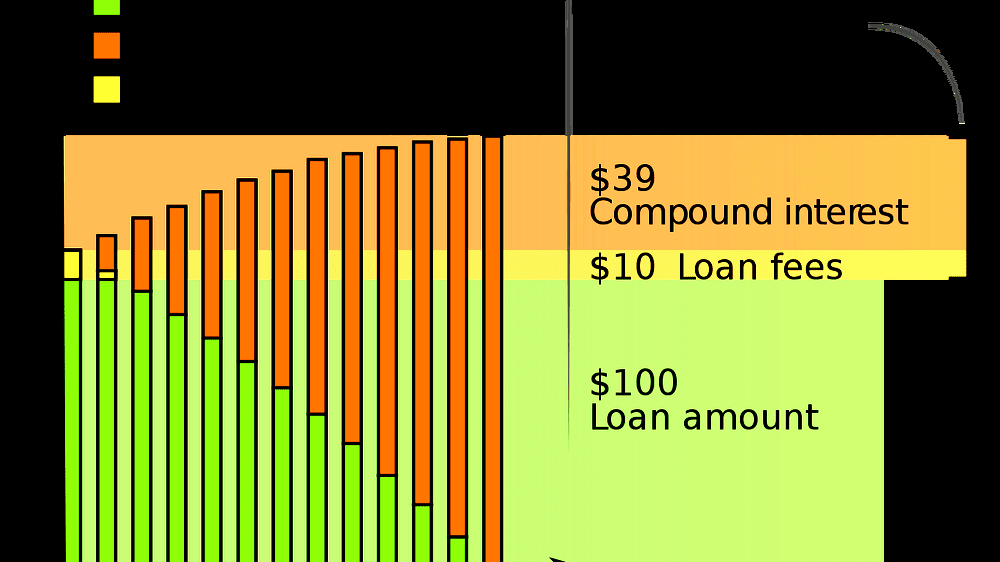

The newest Federal Basic facts during the Lending laws requires that the creditors reveal the newest Annual percentage rate when they market a speeds. The Apr was designed to establish the true cost of getting money, because of the demanding one specific, although not the, closing fees are part of this new Annual percentage rate formula. Such charge in addition to the interest rate dictate the fresh estimated cost of money across the full term of loan. Since most people do not secure the mortgage for the whole loan identity, it could be mistaken to help you pass on the effect of a few regarding such at the start will set you back over the entire financing title.

Together with, unfortuitously, brand new Annual percentage rate doesn’t become every closure fees and you can loan providers are permitted to understand which costs they include. Charges to possess things such as appraisals, label functions, and you may file planning aren’t incorporated although you are going to enjoys to blow them.

To have adjustable rate mortgage loans, the Annual percentage rate shall be significantly more complicated. Given that no-one knows just what market conditions have been around in the near future, presumptions should be generated away from upcoming speed adjustments.

You can utilize the fresh Annual percentage rate because the a guideline to invest in fund however should not depend only towards the that’s top to you. Evaluate total charges, possible price customizations subsequently when you’re researching varying speed mortgages, and take into account the length of time which you thinking about having the mortgage.

Don’t forget that the latest Apr is an efficient interest rate–not the real rate of interest. Your own monthly payments depends towards the actual interest, the total amount you obtain, additionally the term of one’s mortgage.

The maximum portion of their house’s well worth utilizes the point of your own loan, the method that you make use of the assets, while the mortgage style of you choose, therefore, the best method to determine what loan amount we could promote would be to over all of our on the web application.

The rate loans Northwest Harwinton CT marketplace is subject to motions versus progress see. Securing for the an increase protects you against enough time that your lock is actually verified for the big date that lock months ends. The interest rate try locked getting 60 days regarding the date a beneficial property is known and you will Borrowing Relationship step 1 try informed.

Is always to interest rates rise during that months, we are obligated to honor the brand new committed price. Is always to interest levels fall throughout that months, brand new debtor can get demand a single-time relock within straight down rates.

A beneficial secure are a binding agreement by the borrower and also the bank and you can specifies just how many months where good loan’s attract rate try protected

The pace are secured for 60 days regarding date a great home is known and Credit Union step one was informed. It means your loan need personal and you can disburse in 60 morning several months. Should your financing will not personal and you can disburse within the 1st 2 month secure months, the interest rate might be relocked at newest rate having an even more 60 days.