Content

- What’s the difference between gross sales and net sales?

- Motivate your sales team

- Frequently asked questions about net sales

- .css-177mjipposition:absolute;opacity:0;top:calc(-72px – 20px); How to calculate net sales

- Major Customer Service Challenges

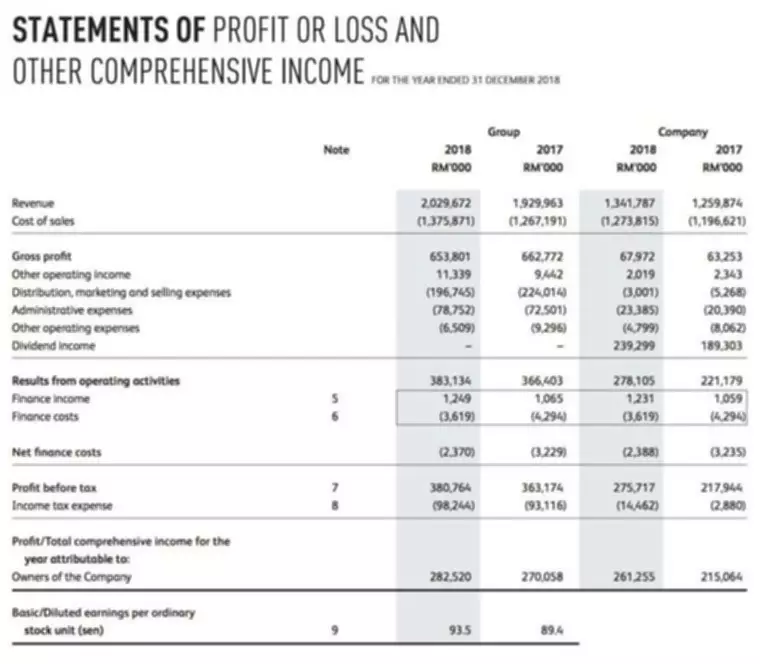

- How to add gross and net sales on an income statement

- Unlock a measurable sales pipeline

To avoid getting overwhelmed, use a sales CRM like Zendesk Sell to keep tabs on all the important metrics. Zendesk automates the measurement of sales metrics so you can focus on keeping your top and bottom lines strong. But they’re not the only sales metrics you should analyze and monitor regularly.

- Let us take the example of a company that sold 100,000 units during the year, each unit worth $5.

- Businesses that offer both physical products and services may even include both metrics in their financial statements.

- Note the sales allowance on pen and paper in a journal or a digital entry in an Excel or Word document for tracking purposes.

- A business may decide to administer a sales allowance to increase customer satisfaction during a situation gone wrong.

- In some cases, companies will choose to report both gross and net sales, but they will always be displayed as separate line items.

Pinpoint the campaigns that impacted metrics such as net sales and cost of sales. As long as you calculate net sales monthly, add the 12 values on December 31st to get a yearly net sales amount. Review your sales records from the past month to discover your gross sales. If you are in a service business, you may give your customers a small discount if they pay their bills in full before the due date.

What’s the difference between gross sales and net sales?

And third, after you’ve calculated it, you must know what to do with it. A sales dashboard helps you manage data and key metrics to measure your team’s performance. While gross sales vs. net sales are terms that may be more familiar to accountants and investors, knowing what these mean as a salesperson or sales manager is still vital. It can give you a strong indicator of business performance and help identify any potential issues before they become serious problems. If you find your business offering allowances on a regular basis, something needs to change. Continually offering allowances not only impacts your revenue, but it can make it harder to accurately forecast your future sales.

Is net sales and gross profit the same?

Also called gross profit margin, gross profit ratio is the percentage of gross sales of a particular product or service that is profit above the cost of producing that good. In this formula, net sales equals your gross sales minus returns minus the cost of goods sold.

This simply means you sold $50,000 worth of products but it doesn’t necessarily mean your business has all that income from the sales because other deductions have not yet been considered. A seller will debit a sales discounts contra-account to revenue and credit assets. The journal entry then lowers the gross revenue on the income statement by the amount of the discount. Allowances are less common than returns but may arise if a company negotiates to lower an already booked revenue. If a buyer complains that goods were damaged in transportation or the wrong goods were sent in an order, a seller may provide the buyer with a partial refund. A seller would need to debit a sales returns and allowances account and credit an asset account.

Motivate your sales team

In most cases, you’ll record the gross sales first, followed by discounts and deductions. After you’ve registered net sales, you’ll need to generate an income statement, https://www.bookstime.com/articles/net-sales adding your net sales to your firm’s other revenue streams. Sales revenue is income generated exclusively from the total sales of goods or services by a company.

- The proportion of net sales to gross sales may be of interest to internal and external stakeholders.

- Track sales allowances as they occur in a daily end-of-day log so it’s easier to calculate this portion of sales deductions at the end of the month.

- To calculate the store’s net sales, we remove these three sets of deductions from the $5,000 total sales revenue.

- Gross sales and net sales are two common metrics that offer distinct advantages when it comes to gauging revenue.

- Based on your gross and net sales, you can see where to allocate spending, how much to allocate and where spending might not be necessary.

The exact terms of a discount vary from company to company, but the general idea is to create a mutually beneficial outcome for both parties. The seller gets their invoices paid faster, allowing them to maintain a healthy cash flow, and the customer doesn’t have to pay full selling price. Sales discounts apply to any early payment discounts which are offered to customers when they pay an invoice within a specified period. Gross sales do not factor in deductions, while net sales take into account all the costs incurred during the sales process.

Frequently asked questions about net sales

While gross sales provides information such as how well your products are selling and how successful your business is in reaching customers, tracking net sales totals are just as important. In the month of May, your business sold $62,000 worth of products on credit. You also gave discounts to three early-paying customers that totaled $1,100. Put simply, gross sales are your total before any VAT, discounts or other amounts are removed.

Are net sales the same as net revenue?

Net sales, or net revenue, is the money your company earns from doing business with its customers. Net income is profit – what's left over after you account for all revenue, expenses, gains, losses, taxes and other obligations.

Understanding and tracking sales deductions is essential for discovering monthly net sales. Gross sales are your total sales for a specific period before accounting for any deductions such as sales allowances, sales discounts, and sales returns. The subtracted portion includes three numbers from the sales deductions discussed above.

.css-177mjipposition:absolute;opacity:0;top:calc(-72px – 20px); How to calculate net sales

Your gross sales might look great, but if your business is getting a lot of returns, your net sales will show it. Compare your own figures with competitors to see how you’re performing in the marketplace and identify new opportunities and areas of improvement in your existing sales processes. In this context, “sales discounts” doesn’t refer to sales promotions, promotional discounts or rebates and seasonal offers, it only applies to the early payment discount.

Calculate net sales by subtracting three types of sales deductions from gross sales. Track your discounts throughout the month by keeping records of all promotions, coupons, or early bill payoff deductions. With all of these values to track, it can be challenging to keep careful records of sales and deductions. However, you can follow these tips to track business income and losses accordingly so you are ready to generate your monthly income statement. Here is a layout of the equation below showing how to calculate sales deductions before subtracting them from gross sales.

Major Customer Service Challenges

While the product still functions correctly, the customer might ask for compensation given that the delivered goods weren’t as described. To keep the customer happy, https://www.bookstime.com/ your company might offer a partial refund of $300. Sales returns allow customers to return an item for a full or partial refund within a certain number of days.

- If your gross sales are high but net sales indicate that one of your products is being returned more than usual, you can use this information to identify what’s wrong.

- Then, with your chosen accounting software, you can input these sales records for the final gross sales calculation.

- For example, your company might send a customer an invoice for $10,000 to be paid within 30 days.

If you know the difference between gross and net sales company-wide, team-wide and individually, you can accurately measure and analyze performance. This means you can monitor sales performance and set goals that motivate your sales team to focus on the right targets. Gross sales allow you to measure the total amount of revenue made by your sales team, whereas net sales are a better measure of performance, sales tactics and product/service quality.

Keep All Sales Return Receipts

Analyzing your company’s net sales formula can help you make more informed decisions. For example, if your net sales ended up being lower than you budgeted for, you may need to consider lowering your prices to attract more customers. On the last day of the month, analyze your gross sales by viewing the detailed reports from either the sales tracking or accounting software. Make more time to handle other tasks within your business and experience less hassle with calculating net sales every month. Net sales are calculated by deducting the cost of sales—allowances, discounts, and returns—from the total revenue. For companies using accrual accounting, they are booked when a transaction takes place.