If you find yourself trying to find a little extra cash, family guarantee financing, home loans and private money may be worth offered. According to course and you will intent behind the mortgage, one is most readily useful geared to your position. Like, house collateral finance and personal finance have a similar objective where it let the borrower to obtain dollars for any reason. Lenders, on the other hand, are utilized solely to simply help pay money for property. In spite of the similar category of names, domestic equity loans and you can home loans express precisely the equity- your house. The attention rates, payment times and needs disagree. Also, personal loans are a lot reduced and borrowed having less time physique than the most other one or two stated, rendering her or him optimal to own less, certain sales. The malfunction of every mortgage less than tend to describe its biggest distinctions, powering one the leader of mortgage for the condition.

Table away from Material

- What’s a house Guarantee Loan?

- Home Equity Mortgage versus. Home loan

- Family Collateral Loan vs. Unsecured loan

- How to find an informed Loan to your requirements

What is actually a property Guarantee Mortgage?

Home security money, known as possessions financial support and you will next mortgage loans, try an ever more popular way for Singaporeans to get a large sum of money through its home due to the fact guarantee (usually to 75% of the property value). Because you don’t need to disclose the objective of the borrowed funds, home collateral money is smoother for those who you would like currency to have debt consolidation and you may restructuring, and for higher repayments particularly degree, medical debts otherwise home improvements. You should buy financing tenor of up to thirty five years otherwise until you turn 75 years of age- any sort of try shorter.

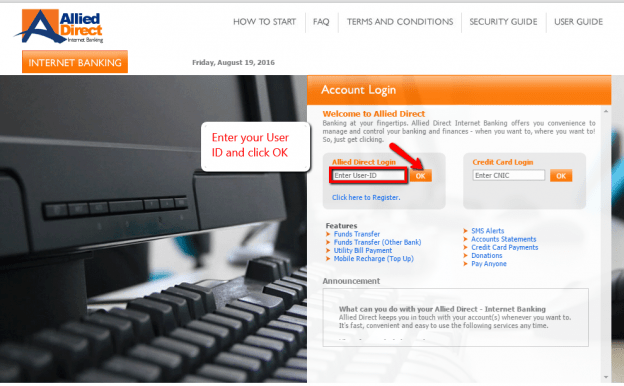

Home collateral financing are only designed for people who own individual services and you may HDB Manager condominiums. You can aquire a home equity loan from a timeless banking companies like HSBC and you may UOB within cost tied to SIBOR, and therefore claims transparency from the cost techniques. As the rates is up to step one% p.a great., family collateral money are among the minimal funding options to your the market industry. Although not, you should keep in mind that same as lenders, make an effort to shell out valuation and courtroom charge that may diversity for the one or two several thousand dollars.

House Guarantee Financing against. Home loans

If you’re house equity money and you may mortgage brokers sound comparable, their objectives are generally very different. As opposed to home security money which you can use to have things, home loans (assets finance) is actually an easy method for all of us so you can procure funding to find a good new home. Although not, specific provides are equivalent, including the limitation investment (around 75% of the home really worth) and you may tenor (as much as 31-thirty five decades) As there are both financing getting individual characteristics and you may HDB flats, choosing the best that for the situation is important.

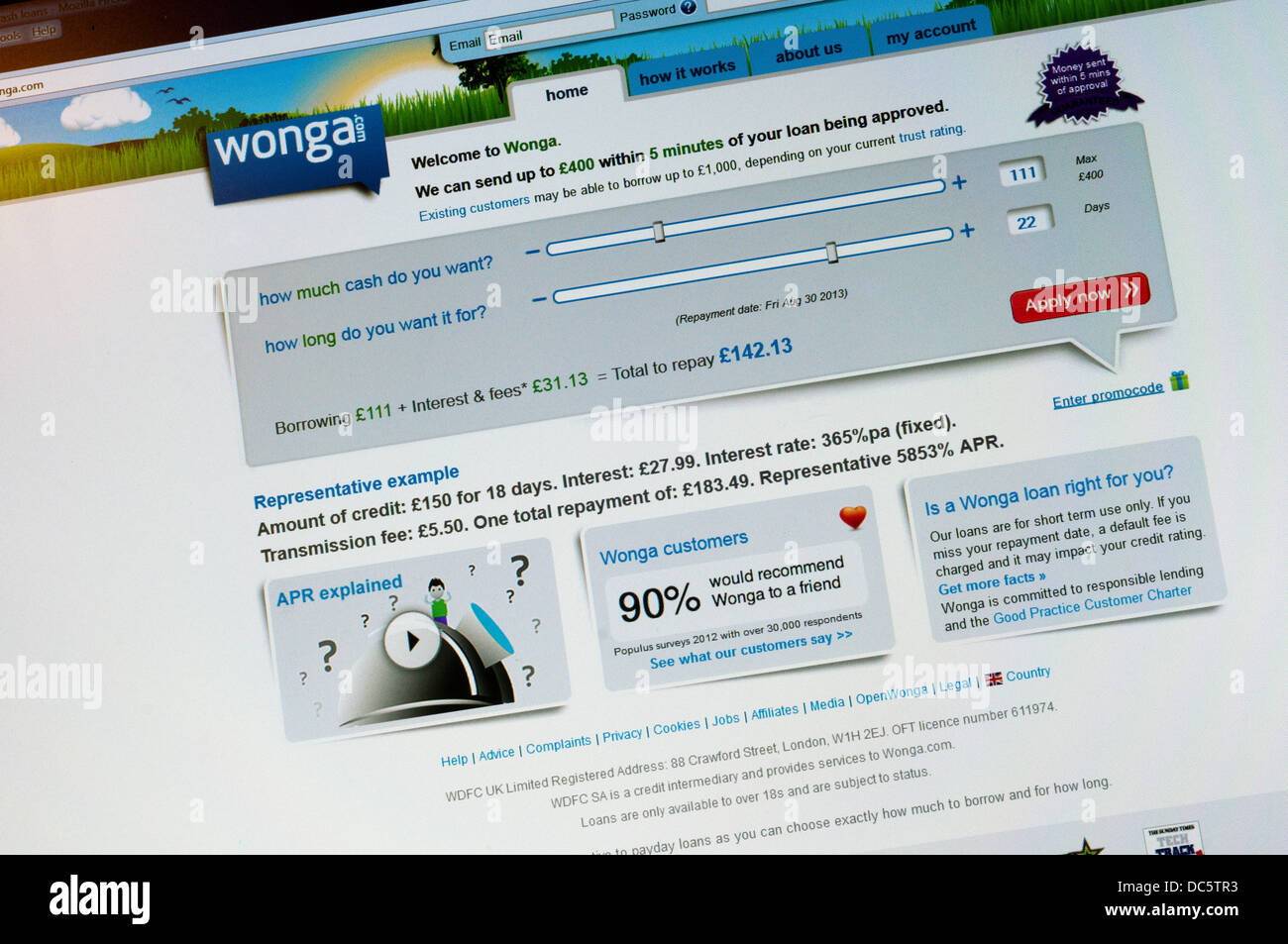

In order to qualify for a home loan, you must be 21 many years or older, enjoys good credit, and you may the very least annual money of S$twenty-four,100. Exactly like a property guarantee loan, you might borrow funds for a long period, therefore, the interest rates could well be perhaps one of the most very important issues payday loan New Castle Colorado inside the choosing and that supplier to go with. Most mortgage brokers average between 1%-3% to possess fixed otherwise floating packages, but more than a long period of energy possibly the littlest improvement will cost you a substantial count. Why lenders possess low interest is mainly because these include thought « secured » finance, in which you risk your residence for many who standard. If you need a home loan, try our home Online calculator to test and that mortgage is best suited to you personally.